Date: 1/30/2026

Place: Virtual

Timezone: Eastern

What You’ll UnlockInside the Ultimate Destiny Framework

A step-by-step blueprint to help you discover the person heaven designed you to be—unlocking your purpose, influence, and legacy one breakthrough at a time. This transformative experience is delivered exclusively through live, interactive Zoom sessions.

Have you ever felt like you’re living below your potential ?

Like you know God has more for you… but something keeps holding you back? That was me. Until I discovered the true power of identity, purpose, and faith-fueled action. That’s what BeingMe is all about.

Live on Purpose, Not on Autopilot.

Too many people wake up already overwhelmed—racing to catch up with emails, expectations, and the demands of others. They stay busy, but deep down, they feel stuck. Tired. Unfulfilled.

That’s not the life you were created for.

At Being Me, we believe your life is not random—it’s prophetic. It’s meant to reflect both your identity and your God-given assignment. When you discover who you are in Christ, you stop living by default… and start living by divine design.

This isn’t about doing more. It’s about being—being you.

“I discovered the power of choice and the courage to be. Everything changed when I opened myself to the possibilities of God. Let me show you how I did it….”

Kirwin M. Narine

Unlock You. Rewrite Your Blueprint. Dream Bigger.

Say goodbye to fear, doubt, and confusion—and hello to clarity, confidence, and calling.

Key benefits: By the End of This Experience, I Will…

Real Change. Real Lives.

“I’m able to scale my business with confidence, knowing who I am in Christ and the limitless possibilities He has in store for my life.”

Justin D. Roberts

CEO, Fi Clothing Store

“God opened my eyes to see who He has really made me to be. Once like a cocoon trapped in the world, I am now free and blooming in Christ and business—just like a butterfly! “

Jordan Daniell

CEO, Bloomed Care

“ it has changed my thinking and brought home the reality of who I really am in Christ and this has led to a revolution in my prayer life and even reading of the Word and my daily walk as a believer. “

Kevin Jardim

Business Leader

“Being Me helped me embrace my God-given gifts and live without fear. As a leading actor, I now express my creativity with confidence, knowing who I am in Christ.”

Chrisal Martin

Leading Actor

Kirwin has led high-impact organizations including the Sniper Club, a top-tier trading and investment firm, and hosted The 100x Lab, where he explored the future of capital, innovation, and human potential.

With over 30 years of experience, Kirwin has trained tech leaders from NASA, AT&T, and American Airlines, and helped pioneer tech education in the Caribbean. His investor briefings connect decision-makers across AI, Blockchain, and Robotics, shaping conversations at the highest levels.

Today, Kirwin merges faith and leadership to build transformative ecosystems that shift culture and unlock purpose. He shares his journey with his wife Onikka and daughter Kristin.

Schedule Break Down 7 Days to Destiny

This is not just a teaching.

It’s a transformation experience. Here’s how we’ll walk through it together…

Day 1:

Identity Code

Break free from false labels and step into who God says you are. Rewire your internal beliefs and restore your God-given identity with truth, scripture, and mirror work.

Day 2:

The Destiny Blueprint

Discover the purpose you were created for. Get clear on your life’s calling and begin mapping out how to walk in it with intentionality and alignment.

Day 3:

Limitless Me

Identify limiting beliefs and patterns that sabotage your growth. Replace them with declarations rooted in God’s power so you can rise beyond your past and live without limits.

Day 4:

Wealth Formula

Shift your money mindset through biblical truths. Learn practical wealth strategies that help you steward resources, break lack, and walk in divine provision.

Day 5:

Influence: Rise & Reign

Discover your leadership voice and how to use your influence to shape culture and uplift others. Step into spiritual authority with confidence.

Day 6:

Legacy Architects

Redefine success through the lens of eternal impact. Start building something that outlasts you—something rooted in God’s mission, not just your ambition.

Day 7:

Build Your Destiny Tribe

Surround yourself with the right people. Learn the power of alignment, collaboration, and community as you create a support system for your calling.

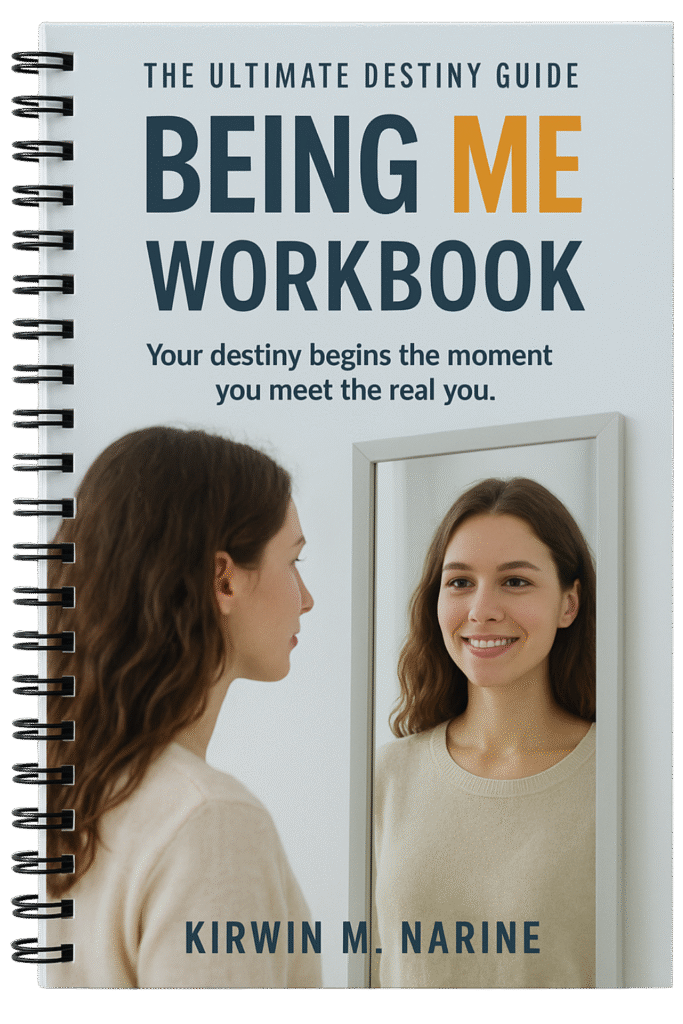

Bonuses You’ll Receive

When you register the Being Me Transformative Experience, you’ll also get:

The Being Transformative Experience

Includes 7-Day Experience

Includes Destiny Workbook

Includes 7-Day Bold Devotional

Includes Replay Access

$150

Includes 7-Day Experience

Includes Destiny Workbook

Includes 7-Day Bold Devotional

Includes Replay Access

$150

Includes 7-Day Experience

Includes Destiny Workbook

Includes 7-Day Bold Devotional

Includes Replay Access

$150

FAQ

Is this for me?

Yes — if you’re ready to break free from fear, confusion, or limitation and discover who God truly created you to be. This experience is for anyone who feels called to live with greater purpose, confidence, and faith.

What if I can’t attend live?

Don’t worry. Life happens! Even if you can’t join live, you’ll still receive full Replay Access so you can go through the session at your own pace and not miss a single breakthrough moment.

Will there be a replay?

Yes. All sessions are recorded and made available for Replay Access within 24 hours after the live event, so you can revisit the teachings anytime.

Is this Christian-based?

Absolutely. The Being Me experience is rooted in Biblical truth and designed to help you understand your God-given identity, destiny, and purpose through the lens of faith.

What do I need to prepare?

Just bring an open heart, a notebook, and your Being Me Workbook if you have one. Find a quiet space where you can fully engage — and expect God to meet you there.